Overview

Chatbots have become an essential part of customer interaction across different industries. However, previously, the chatbots came with rigid rules and pre-defined scripts. This caused negative user experiences. The introduction of NLP chatbot technology has entirely changed this landscape. This technology enables machines to understand human language, intent, and context. Natural Language Processing (NLP) has transformed chatbots into intelligent conversational systems capable of delivering accurate, personalised, and efficient interactions.

What Is Natural Language Processing (NLP)?

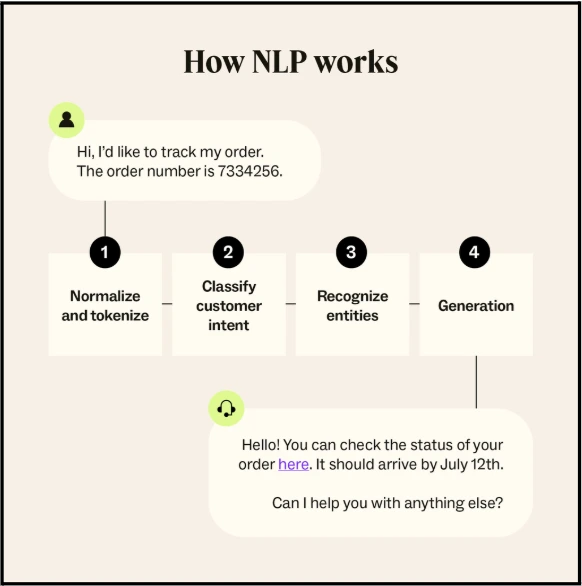

Natural Language Processing is a branch of artificial intelligence that focuses on enabling machines to understand, interpret, and generate human language. A Natural Language Processing chatbot uses NLP techniques such as tokenisation, intent recognition, named entity recognition, and sentiment analysis to process user input more intelligently.

Instead of matching exact keywords, NLP allows chatbots to identify and understand the meaning. For example, queries like “I want to check my policy,” “Show my insurance details,” or “Can I see my coverage?” have the same intent. The NLP-enabled chatbots can understand the meaning, which improves the query solution. This capability significantly improves conversational accuracy and reduces misunderstandings.

Evolution of Chatbots: From Rule-Based to NLP-Powered

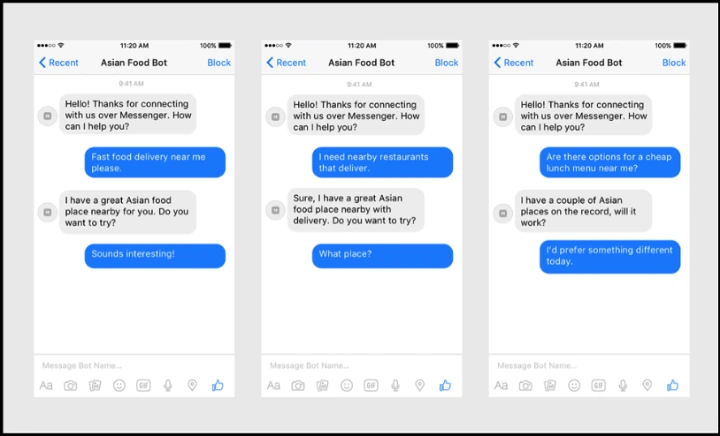

Early chatbots relied on predefined decision trees. These rule-based systems could only respond to exact commands and often failed when user queries mismatched with the exact commands. Even a minor spelling error could lead to an incorrect or no response.

With the integration of NLP and chatbots, conversational systems evolved into learning-based models. NLP-powered chatbots can handle variations in language, recognise intent across different sentence structures, and improve continuously through training data. Studies show that NLP-based chatbots can improve response relevance by nearly 30–40% compared to traditional scripted bots.

How NLP Revolutionises Chatbots

- Improved Intent Understanding

The most significant contribution of NLP is the detection and interpretation of intent. An NLP chatbot does not simply answer the queries, but understands what the user wants to achieve. For instance, when a customer types a 12-word query instead of a simple command, the chatbot can still identify the core intent with a good amount of accuracy. Modern systems often achieve intent recognition accuracy above 85–90% after sufficient training.

- Context-Aware Conversations

In the existing chatbots, customers usually faced issues in communication as they needed to give the context from the start each time they wanted a conversation. Even after that, chatbots failed to give the desired answers all the time effectively. NLP enables chatbots to remember previous interactions within a session. This context awareness allows multi-turn conversations that feel more natural. The users do not have to repeat the previously said informations agin and again. Rather, the chatbot builds on earlier responses. For example, if a user asks about policy eligibility and then follows up with “What about premium cost?”, the chatbot understands the reference without restarting the conversation.

- Sentiment Analysis and Response Optimisation

Another major advancement is sentiment analysis. In this process, the feelings and experiences of the user is analysed. NLP allows chatbots to identify whether a user is satisfied, confused, or frustrated. This is especially valuable in service-based industries. If negative sentiment is detected, the chatbot can adapt its tone or escalate the query to a human agent. Even a 10–15% improvement in sentiment-aware responses can significantly enhance customer satisfaction scores.

- Multilingual and Inclusive Communication

NLP-powered chatbots support multilingual interactions, making them accessible to a global audience. A single chatbot can communicate in 5 or more languages. This reduces the need for separate regional systems. This capability improves inclusivity and expands service reach without proportionally increasing operational costs.

Business Benefits of NLP-Powered Chatbots

From an organisational perspective, NLP-driven chatbots deliver measurable benefits. They provide 24/7 support, reduce customer wait times, and lower service costs. For example, the Bank of America introduced “Erica”, an NLP-powered virtual financial assistant. This has solved tens of millions of queries and financial transactional requests that would require thousands of employees

Additionally, NLP chatbots scale efficiently. Whether handling 100 or 10,000 conversations per day, performance remains consistent. This scalability makes them particularly valuable during peak demand periods.

NLP in Insurance Chatbots: A Transformational Use Case

The application of NLP has been notably impactful in the insurance sector. A chatbot in insurance must be able to handle complex terminology, regulatory requirements, and emotionally sensitive interactions. Traditional chatbots have failed to provide these effectively in this domain. However, NLP has enabled a new generation of intelligent insurance bots.

An NLP-enabled insurance chatbot can assist users with policy details, premium calculations, claim status, and renewal reminders. For example, a life insurance chatbot can answer eligibility questions, explain coverage options, and calculate estimated premiums in under 2 minutes. Conventional chatbots take 24-48 hours to complete these tasks, and still, there were discrepancies.

By analysing user intent and sentiment, insurance chatbots can also personalise recommendations. If a user expresses concern about family security, the chatbot can prioritise relevant life insurance plans rather than generic products. This targeted interaction improves conversion rates and builds customer trust.

Real-World Applications Across Industries

Beyond insurance, NLP chatbots are widely used in e-commerce, banking, healthcare, and education. In e-commerce, they guide product discovery and track orders. In banking, they assist with balance enquiries and transaction histories. In healthcare, they support appointment scheduling and symptom triage. Across these sectors, NLP-driven automation improves efficiency while maintaining conversational quality.

Challenges of NLP-Based Chatbots

Despite their advantages, NLP chatbots face challenges. Understanding highly complex queries remains difficult. The NLP-powered chatbots, too, sometimes fail to solve the most complex queries. Other than that, Bias has been one of the major concerns. Bias in training data can affect response accuracy. Maintaining data privacy is critical, especially in regulated industries like insurance and healthcare. In the online space, keeping sensitive data private is very challenging.

Additionally, initial development and training costs can be high. However, these costs are often offset within the first year through reduced operational expenses and improved service efficiency.

The Future of NLP and Chatbots

The future of chatbot technology lies in deeper integration with generative AI, voice-based interfaces, and advanced personalisation. NLP models will continue to improve contextual understanding, enabling chatbots to handle increasingly complex conversations. Over time, chatbots are expected to evolve from reactive assistants into proactive digital advisors.

Conclusion

The rise of the NLP chatbot marks a significant shift in how organisations interact with customers. By enabling intent recognition, contextual awareness, and emotionally intelligent responses, NLP has revolutionised chatbot capabilities. Its application in domains such as insurance demonstrates how conversational AI can deliver both operational efficiency and enhanced customer experience. As NLP technologies mature, chatbots will play an even more strategic role in digital transformation initiatives across industries.